A cryptocurrency entrepreneur launched a blockchain religion. Absolutely no one is surprised.

Category: bitcoin – Page 49

I get this question a lot. Today, I was asked to write an answer at Quora.com, a Q&A web site at which I am the local cryptocurrency expert. It’s time to address this issue here at Lifeboat.

Question

I have many PCs laying around my home and office.

Some are current models with fast Intel CPUs. Can

I mine Bitcoin to make a little money on the side?

Answer

Other answers focus on the cost of electricity, the number of hashes or teraflops achieved by a computer CPU or the size of the current Bitcoin reward. But, you needn’t dig into any of these details to understand this answer.

You can find the mining software to mine Bitcoin or any other coin on any equipment. Even a phone or wristwatch. But, don’t expect to make money. Mining Bitcoin with an x86 CPU (Core or Pentium equivalent) is never cost effective—not even when Bitcoin was trading at nearly $20,000. A computer with a fast $1500 graphics card will bring you closer to profitability, but not by much.

The problem isn’t that an Intel or AMD processor is too weak to mine for Bitcoin. It’s just as powerful as it was in the early days of Bitcoin. Rather, the problem is that the mining game is a constantly evolving competition. Miners with the fastest hardware and the cheapest power are chasing a shrinking pool of rewards.

The problem arises from a combination of things:

- There is a fixed rate of rewards available to all miners—and yet, over the past 2 years, hundreds of thousands of new CPUs have been added to the task. You are competing with all of them.

- Despite a large drop in the Bitcoin exchange rate (from $19,783.21 on Dec. 17, 2017), we know that it is generally a rising commodity, because both speculation and gradual grassroots adoption outpaces the very gradual increase in supply. The rising value of Bitcoin attracts even more individuals and organizations into the game of mining. They are all fighting for a pie that is shrinking in overall size. Here’s why…

- The math (a built-in mechanism) halves the size of rewards every 4 years. We are currently between two halving events, the next one will occur in May 2020. This halving forces miners to be even more efficient to eke out any reward.

- In the past few years, we have seen a race among miners and mining pools to acquire the best hardware for the task. At first, it was any CPU that could crunch away at the math. Then, miners quickly discovered that an nVidia graphics processor was better suited to the task. Then ASICS became popular, and now; specialized, large-scale integrated circuits that were designed specifically for mining.

- Advanced mining pools have the capacity to instantly switch between mining for Bitcoin, Ethereum classic, Litecoin, Bitcoin Cash and dozens of other coins depending upon conditions that change minute-by-minute. Although you can find software that does the same thing, it is unlikely that you can outsmart the big boys at this game, because they have super-fast internet connections and constant software maintenance.

- Some areas of the world have a surplus of wind, water or solar energy. In fact, there are regions where electricity is free.* Although regional governments would rather that this surplus be used to power homes and businesses (benefiting the local economy), electricity is fungible! And so, local entrepreneurs often “rent” out their cheap electricity by offering shelf space to miners from around the world. Individuals with free or cheap electricity (and some, with a cold climate to keep equipment cool) split this energy savings with the miner. This further stacks the deck against the guy with a fast PC in New York or Houston.

Of course, with Bitcoin generally rising in value (over the long term), this provides continued incentive to mine. It is the only thing that makes this game worthwhile to the individuals who participate.

Of course, with Bitcoin generally rising in value (over the long term), this provides continued incentive to mine. It is the only thing that makes this game worthwhile to the individuals who participate.

So, while it is not impossible to profit by mining on a personal computer, if you don’t have very cheap power, the very latest specialized mining rigs, and the skills to constantly tweak your configuration—then your best bet is to join a reputable mining pool. Take your fraction of the mining rewards and let them take a small cut. Cash out frequently, so that you are not locked into their ability to resist hacking or remain solvent.

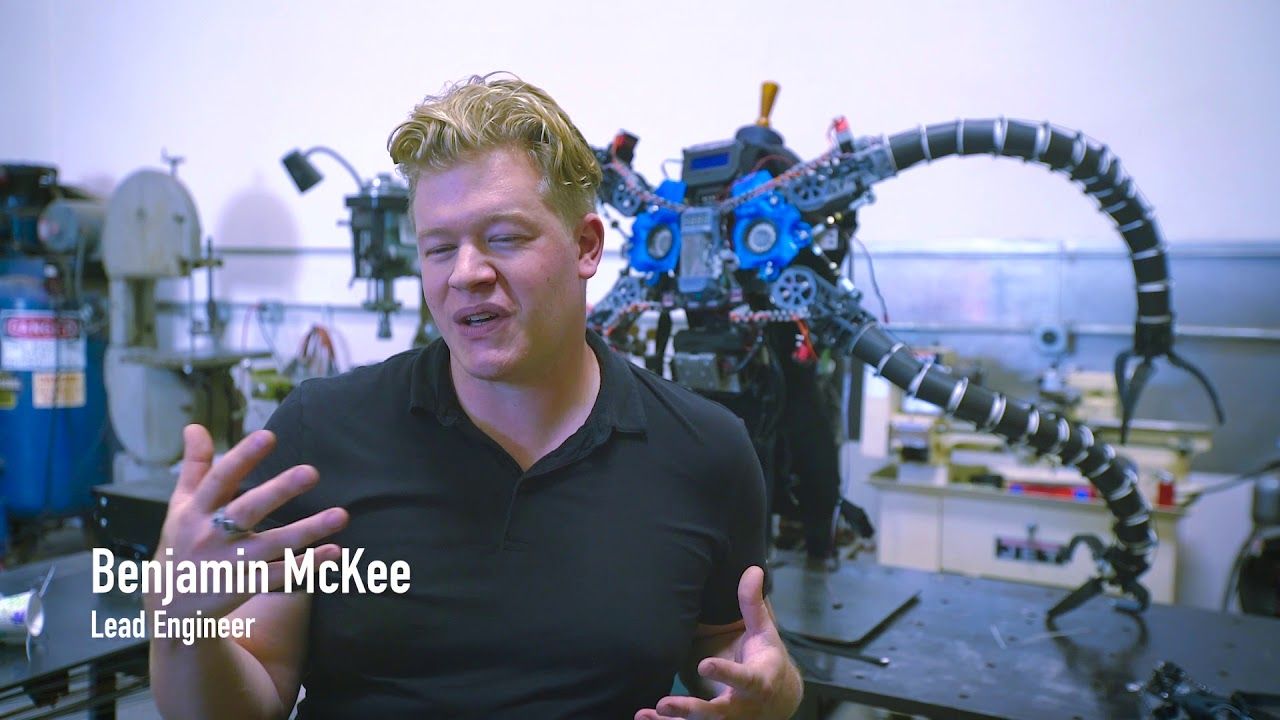

Related: Largest US operation mines 0.4% of daily Bitcoin rewards. Listen to the owner describe the effiiency of his ASIC processors and the enormous capacity he is adding. This will not produce more Bitcoin. The total reward rate is fixed and falling every 4 years. His build out will consume a massive amount of electricity, but it will only grab share from other miners—and encourage them to increase consuption just to keep up.

* Several readers have pointed out that they have access to “free power” in their office — or more typically, in a college dormitory. While this may be ‘free’ to the student or employee, it is most certainly not free. In the United States, even the most efficient mining, results in a 20 or 30% return on electric cost—and with the added cost of constant equipment updates. This is not the case for personal computers. They are sorely unprofitable…

So, for example, if you have 20 Intel computers cooking for 24 hours each day, you might receive $115 rewards at the end of a year, along with an electric bill for $3500. Long before this happens, you will have tripped the circuit breaker in your dorm room or received an unpleasant memo from your boss’s boss.

Bitcoin mining farms —

- Professional mining pool (above photo and top row below)

- Amateur mining rigs (bottom row below)

This is what you are up against. Even the amateur mining operations depicted in the bottom row require access to very cheap electricity, the latest processors and the skill to expertly maintain hardware, software and the real-time, mining decision-process.

Philip Raymond co-chairs CRYPSA, hosts the New York Bitcoin Event and is keynote speaker at Cryptocurrency Conferences. He sits on the New Money Systems board of Lifeboat Foundation. Book a presentation or consulting engagement.

Some market observers worry the solutions to problems the new technologies offer might become the causes of other problems. With AI gathering steam and large amounts of data flowing to empower machine learning, how to protect privacy in a region where the use of personal information is loosely regulated has become a pressing question.

Filing taxes using blockchain in Indonesia. Growing better crops in Vietnam with artificial intelligence. Sending rockets into space in Singapore. Southeast Asia is quietly emerging as a breeding ground for new technology.

The attack on Rockport is one example in a rising tide of similar invasions of municipal systems across the U.S.—from major cities like Atlanta, which got hit in March, to counties, tiny towns and even a library system in St. Louis. Local governments are forced to spend money on frantic efforts to recover data, system upgrades, cybersecurity insurance and, in some cases, to pay their online extortionists if they can’t restore files some other way.

Hackers are targeting small towns’ computer systems, with public-sector attacks appearing to be rising faster than those in the private sector. Online extortionists demand bitcoin ransom in return for decryption keys.

It seems that Microsoft isn’t done experimenting with blockchain technology.

Microsoft and Ernst & Young (EY) announced the launch of a blockchain solution for content rights and royalties management on Wednesday.

The blockchain solution is first implemented for Microsoft’s game publisher partners. Indeed, gaming giant Ubisoft is already experimenting with the technology.

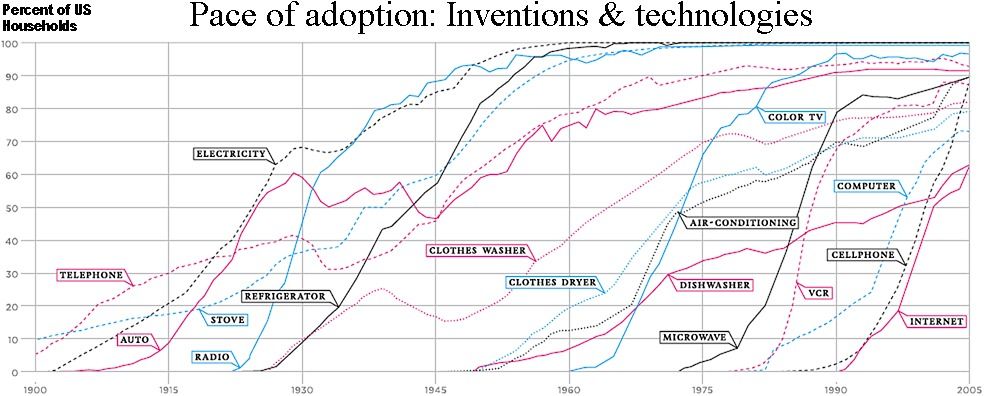

Early adopters, speculators and Geeks are never sufficient to bring a new paradigm to market. Mass appeal and adoption of a mechanism that requires education and a change of behavior is never ‘fait accompli’—until it reaches a tipping point. Once at the tipping point, it can go viral without a structured PR campaign and with risks tied only to technology and scalability.

The question was asked of me as columnist at Quora.com: Will governments eventually ‘approve’ of cryptocurrency? First let’s agree on terminology…

- By “approve”, I assume that you are asking if governments will adopt or at least tolerate the use of crypto as legal tender in commerce. That is, not just as a payment instrument, but as the money itself—perhaps even accepting tax payments in cryptocurrency.

- The word “cryptocurrency” is sometimes applied to altcoins and even to ICOs. These are not the same. Many altcoins meet the criteria of the next paragraph, but none of the ICOs measure up (ICOs are scams). I assume that your question applies to Bitcoin or to a fair and transparent altcoin forked from the original code, such as Bitcoin Cash or Litecoin.

A blockchain-based cryptocurrency that is open source, permissionless, capped, fast, frictionless, with a transparent history—and without proprietary or licensing restrictions is good for everyone. It is good for consumers; good for business; and it is even good for government.

Of course, politicians around the world are not quick to realize this. It will take years of experience, education, and policy experimentation.

Many pundits and analysts have the impression that shifting to cryptocurrency—not just as a payment instrument, but as the money itself—will never be supported by national governments. A popular misconception suggests that a cryptocurrency based economy has these undesirable traits:

- it is deflationary (i.e. that inflation is necessary to promote spending or to accommodate a growing economy)

- it facilitates crime

- it interferes with tax collection

- It interferes with national sovereignty, which leads to “world government”

- It is not backed by anything, or at least not by anything substantial, like the Dollar, Euro, Pound, Yuan or Yen

- it interferes with a government’s ability to control its own monetary policy

Over time, perceptions will change, because only the last entry is true. Adoption of cryptocurrency puts trust into math rather than the whims of transient politicians. It helps governments avoid the trap of hoisting debt on future generations or making promises to creditors that they cannot keep—Yet, it does not lead to the maladies on this list.

But, what about that last item? Does an open source currency cause a nation to lose control over its own monetary policy? Yes! But it is not bad! Crypto cannot be printed, gamed or manipulated. Despite perception, it is remarkably resistant to loss or theft. Early hacks and fiascos were enabled by a lack of standards, tools and education. As with any new technology—especially one that changes practices or institutions—adoption of radical processes goes hand-in-hand with gradual understanding and acceptance of benefits.

But, what about that last item? Does an open source currency cause a nation to lose control over its own monetary policy? Yes! But it is not bad! Crypto cannot be printed, gamed or manipulated. Despite perception, it is remarkably resistant to loss or theft. Early hacks and fiascos were enabled by a lack of standards, tools and education. As with any new technology—especially one that changes practices or institutions—adoption of radical processes goes hand-in-hand with gradual understanding and acceptance of benefits.

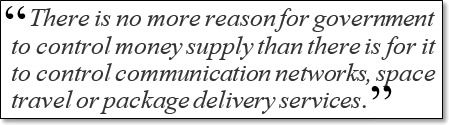

How Does Crypto Help Governments?

Adopting/accepting a national (or international) cryptocurrency is a terrific way for governments to earn the respect and trust of citizens, businesses, consumers and especially creditors. There is no more reason for governments to control their money supply than there is for them to control communication networks, space travel or package delivery services.

You may not agree that cryptocurrency is good for government, and so I expand on the topic here. But your question doesn’t ask if it is good, it asks if governments are likely to approve.

Yes. Eventually…

First, a few forward thinking countries like Iceland, Japan or UAE will spearhead adoption of a true, permissionless cryptocurrency (or at least recognize it as legal tender) . Later, ‘stress-economies’ will join the party: These are countries that need to control either rampant inflation, a reluctance to tax citizens, treasury mismanagement or massive international debt. A solution to these problems requires restoration of public trust. I wouldn’t be surprised to see Greece, Zimbabwe, Venezuela or Argentina in the mix.*

Eventually, G7 countries will tread into a growing ocean. Not now; but in 5 or 8 years. The conditions are not yet right. It requires further vetting by early adopters, continued development, education and then popular consumer adoption. But all of these things are inevitable. Eventually, governments will recognize that a capped, trusted, transparent, math-based money is far better for all stakeholders than money based on intrinsic value, promise-of-redemption or force.

- Related: Is Cryptocurrency Good for Government?

* We are not discussing countries that plan to create their own cryptocurrency. None of these plans involve a coin that is open source, permissionless, decentralized and capped. They are simply replacing paper with a national debit card. But it is not crypto.

Philip Raymond co-chairs CRYPSA, hosts the New York Bitcoin Event and is keynote speaker at Cryptocurrency Conferences. He sits on the New Money Systems board of Lifeboat Foundation. Book a presentation or consulting engagement.

I love clearing the air with a single dismissive answer to a seemingly complex question. Short, dismissive retorts are definitive, but arrogant. It reminds readers that I am sometimes a smart a*ss.

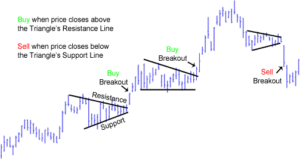

Is technical analysis a reasoned approach for

investors to predict future value of an asset?

In a word, the answer is “Hell No!”. (Actually, that’s two words. Feel free to drop the adjective). Although many technical analysts earnestly believe their craft, the approach has no value and does not hold up to a fundamental (aka: facts-based) approach.

One word arrogance comes with an obligation to substantiate—and, so, let’s begin with examples of each approach.

Investment advisors often classify their approach to studying an equity, instrument or market as either a fundamental or technical. For example…

- Fundamental research of a corporate stock entails the analysis of the founders’ backgrounds, competitors, market analysis, regulatory environment, product potential and risks, patents (age and legal challenges), track record, and long term trends affecting supply and demand.A fundamental analysis may study the current share price, but only to ascertain the price-to-earnings ratio compared to long term prospects. That is, has the market bid the stock up to a price that lacks a basis for long term returns?

. - On the other hand, a technical approach tries to divine trends from recent performance—typically charting statistics and pointing to various graph traits such as resistance, double shoulders, and number of reversals. The approach is more concerned with assumptions and expectations of investor behavior—or hypotheses and superstition related to numerology—than it is with customers, products, facts and market demand.

Do you see the difference? Fundamental analysis is rooted in SWOT: Study strengths, weaknesses, opportunities, and threats. Technical analysis dismisses all of that. If technical jargon and approach sound a bit like a Gypsy fortune teller, that’s because it is exactly that! It is not rooted in revenue and market realities. Even if an analyst or advisor is earnest, the approach is complete hokum.

Do you see the difference? Fundamental analysis is rooted in SWOT: Study strengths, weaknesses, opportunities, and threats. Technical analysis dismisses all of that. If technical jargon and approach sound a bit like a Gypsy fortune teller, that’s because it is exactly that! It is not rooted in revenue and market realities. Even if an analyst or advisor is earnest, the approach is complete hokum.

I have researched, invested, consulted and been an economic columnist for years. I have also made my mark in the blockchain space. But until now, I have hesitated to call out technical charts and advisors for what they are…

Have you noticed that analysts who produce technical charts make their income by working for someone? Why don’t they make a living from their incredible ability to recognize patterns and extrapolate trends? This rhetorical question has a startlingly simple answer: Every random walk appears to have patterns. The wiring of our brain guarantees that anyone can find patterns in historical data. But the constant analysis of patterns by countless investors guarantees that the next pattern will be unrelated to the last ones. That’s why short term movement is called a “random walk”. Behaviorists and neuroscientists recognize that apparent relationships of past trends can only be correlated to future patterns in the context of historical analysis (i.e. after it has occurred).

Decisions based on a technical analysis—instead of solid research into fundamentals—is the sign of an inexperienced or gullible investor. Some advisors who cite technical charts know this. Technicals have no correlation to long term appreciation, asset quality or risks. They only point to short term possibilities.

The problem with focusing on short-term movement is that you will certainly lose to insiders, lightning-fast program traders, built in arbitrage mechanisms and every unexpected good news/bad news bulletin.

If you seek to build a profit in the long run, then do your research up front, enter gradually, and hold for the long term. Of course, you should periodically reevaluate your positions and react to significant news events from trusted sources. But you should not anguish over your portfolio every day or even every month.

- Know your objectives

- Set realistic targets

- Research by reading contrarians and skeptics (They help you to avoid confirmation bias)

- Study comparables and reason through the likelihood that another technology or instrument poses a threat to the asset that interests you

- Then, invest only what you can afford to lose and don’t second guess yourself frequently

- Dollar-cost-average

- Revaluate semi-annually or when meeting with direct sources of solid, fundamental information

Finally, if someone tries to dazzle you with charts of recent performance and talk of a “resistance level” or support trends, smile and nod in approval—but don’t dare fall for the Ouija board. Send them to me. I will straighten them out.

Who says so? Does the author have credentials?

I originally wrote this article for another publication. Readers challenged my credentials by pointing out that I am not a academic economist, investment broker or financial advisor. That’s true…

I am not an academic economist, but I have certainly been recognized as a practical economist. Beyond investor, and business columnist, I have been keynote speaker at global economic summits. I am on the New Money Systems Board at Lifeboat Foundation, and my career is centered around research and public presentations about money supply, government policy and blockchain based currencies. I have advised members of president Obama’s council of economic advisors and I have recently been named Top Writer in Economics by Quora.

I am not an academic economist, but I have certainly been recognized as a practical economist. Beyond investor, and business columnist, I have been keynote speaker at global economic summits. I am on the New Money Systems Board at Lifeboat Foundation, and my career is centered around research and public presentations about money supply, government policy and blockchain based currencies. I have advised members of president Obama’s council of economic advisors and I have recently been named Top Writer in Economics by Quora.

Does all of this qualify me to make dismissive conclusions about technical analysis? That’s up to you! This Lifeboat article is an opinion. My opinion is dressed as authoritative fact, because I have been around this block many times. I know the score.

Related:

Philip Raymond co-chairs CRYPSA, hosts the Bitcoin Event and is keynote speaker at Cryptocurrency Conferences. He sits on the Lifeboat New Money Systems board. Book a presentation or consulting engagement.