Elon Musk’s role in Tesla’s early history has been a point of contention. Eberhard has sued Musk, alleging libel because Musk says he’s a founder.

https://youtube.com/watch?v=-ZeeuDrknYc&feature=share

Technology — An investigation into the advancements in digital technology unique to the gaming industry. They can either enhance our lives and make the world a better place to live, or we may find ourselves in a dystopian future where we are ruled and controlled by the very technologies we rely on.

End Game — Technology (2021)

Director: J. Michael Long.

Writers: O.H. Krill.

Stars: Paul Jamison, Razor Keeves.

Genre: Documentary.

Country: United States.

Language: English.

Release Date: 2021 (USA)

Synopsis:

The technology we rely on for everyday communication, entertainment and medicine could one day be used against us. With facial recognition, drone surveillance, human chipping, and nano viruses, the possibility is no longer just science-fiction. Could artificial intelligence become the dominant life form?

Reviews:

“Shocking insight into the possibilities that lie ahead.” — Philip Gardiner, best selling author.

“Well researched and highly captivating.” — Phenomenon Magazine.

MORE DOCS!

• Through Innovate UK, the Department for Transport has commissioned a Costain led consortium to assess the economic and technical potential of the UK’s first ‘eHighway’

• The study is part of the UK government’s plan to reach zero net emissions for heavy road freight.

• It aims to demonstrate the technology is ready for a national roll-out.

Pests destroy up to 40% of the world’s crops each year, causing $220 billion in economic losses, according to the UN Food and Agriculture Organization (FAO). Trapview is harnessing the power of AI to help tackle the problem.

The Slovenian company has developed a device that traps and identifies pests, and acts as an advance warning system by predicting how they will spread.

“We’ve built the biggest database of pictures of insects in the world, which allows us to really use modern AI-based computing vision in the most optimal way,” says Matej Štefančič, CEO of Trapview and parent company EFOS.

Analysts and e-commerce leaders have been predicting a muted online holiday shopping season this year, with sales in the first three weeks of November essentially flat over a year ago due to a weaker economy, inflation, and more people returning to shopping in stores again in the wake of the Covid-19 pandemic. But on the face of it, the Thanksgiving long weekend appears to be more buoyant than expected — albeit growth has definitely slowed down this year after the pandemic-period boom.

Black Friday broke $9 billion in sales for the first time yesterday, with online sales of $9.12 billion, according to figures from Adobe Analytics. This is a record figure for the day, and up 2.3% on sales figures a year ago, and slightly higher than Adobe had estimated leading up to the day. Adobe doesn’t break out volumes in its report, so it’s hard to know if those figures are due to items simply costing more this year because of inflation, or if the higher numbers are a result of more buying.

Black Friday is a key focus for those gauging how the e-commerce market, and consumer confidence, are both faring in what is the most important and biggest period for shopping in the year.

Every year, the EU generates over 2.5 billion tonnes of waste – that’s 5 tonnes per person. The good news is that much of this waste can be recycled and reused. The bad news, however, is that doing so requires proper collection processes, which is often easier said than done.

“The challenge with waste collection is that it is a widely dispersed process,” says Tjerk Wardenaar, a consultant at EGEN, part of the PNO Group, the project’s lead partner. “Individual consumers discard small amounts of waste, local and regional authorities implement collection systems, waste management companies do the actual collecting, recycling companies recover materials, and so on.”

With the support of the EU-funded COLLECTORS project, Wardenaar aims to increase our understanding of how these various steps relate to one another. “Waste collection depends on a combination of social and technical factors,” he explains. “Our goal is to identify best practices that decision makers can use to implement an integrated waste collection system that supports Europe’s transition to a waste-free, circular economy.”

Check out the on-demand sessions from the Low-Code/No-Code Summit to learn how to successfully innovate and achieve efficiency by upskilling and scaling citizen developers. Watch now.

Today, with the rampant spread of cybercrime, there is a tremendous amount of work being done to protect our computer networks — to secure our bits and bytes. At the same time, however, there is not nearly enough work being done to secure our atoms — namely, the hard physical infrastructure that runs the world economy.

Nations are now teeming with operational technology (OT) platforms that have essentially computerized their entire physical infrastructures, whether it’s buildings and bridges, trains and automobiles or the industrial equipment and assembly lines that keep economies humming. But the notion that a hospital bed can be hacked — or a plane or a bridge — is still a very new concept. We need to start taking such threats very seriously because they can cause catastrophic damage.

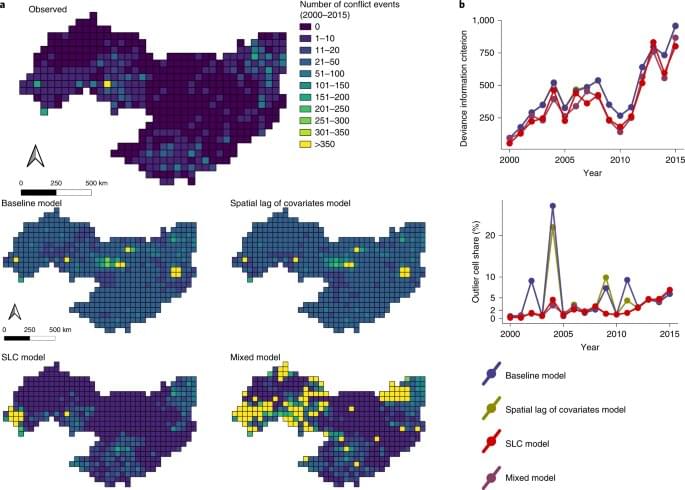

Will today’s wars over oil be over water in the future? For years this question has been at the heart of a scientific debate on the causes of these wars and how they should be studied.

A study published in the prestigious Nature Sustainability by a group of researchers from the Politecnico di Milano has investigated the phenomenon, also in light of “new” types of conflict in which paramilitary groups seem to capitalize on environmental stress.

In order to define the relationship between water and conflict, speaking only of water availability —or lack thereof—is not enough: in fact, conflicts tend to be associated with specific and complex socio-hydrological conditions, which in turn deal with the socio-economic value of water as a form of livelihood, especially in agriculture, and with the effects that human use of water has on the accessibility of this resource.