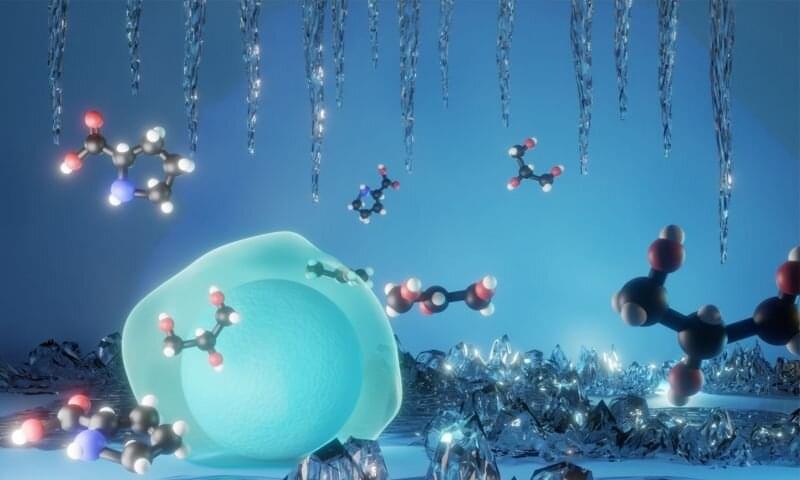

A Matrioshka Brain is a supermassive structure in space consisting of processors and connected to each other into a massive computer around a sun harnessing its energy completely. So far we haven’t built one as we don’t have the technology for it but when we do the question will be if people will be lost in the vast computing power of the Matrishka brain.

Watch all 3 videos with Brendan Caulfield:

3. Future of Humanity https://youtu.be/XbhWEDhcdFk.

2. The Rockets of SpaceX 🚀https://youtu.be/VPgVS9qgBEM

1. The CAR company that will take us to SPACE🚀 https://youtu.be/Y0jiGkAH-pE

Want to make better YouTube videos? You need to understand your DATA and optimize your youtube videos for the audience you want to reach. I recommend using TUBEBUDDY a free Chrome extension that helps you do that:🟥 https://www.tubebuddy.com/BORNATUBERS

#technology #futureofhumanity #elonmusk.

Do you want to find the GOLD in Life? The Uncle Gold Podcast focuses on success in life and how to improve everything we do, from our finances to our happiness, from personal development to social media.

To Listen to the full length interviews find us on all the popular Podcast streaming sites like Spotify, Apple Podcasts, Deezer, TuneIn, and others.